Those of you with double cab pick-ups may remember the previous government’s flip flopping back in February where they initially changed the treatment of Double Cab pickup trucks to class them as cars as opposed to vans following a 2020 Court of appeals judgement.

Within a couple of weeks this decision was reverted citing that the “guidance update could have an impact on businesses and individuals in a way that is not consistent with the government’s wider aims to support businesses, including vital motoring and farming industries.”

As part of Labour’s Autumn statement they announced that, from April 2025, they will be reinstating these rules and, as a result, double cab pickups will be classed as cars for the purposes of Capital Allowances and Benefits in Kind.

It is important to note that should a business purchase, lease or order a double cab pickup before 5th April 2025, they will benefit from the current treatment until the earlier of disposal, lease expiry or 5th April 2029.

So what do the changes mean?

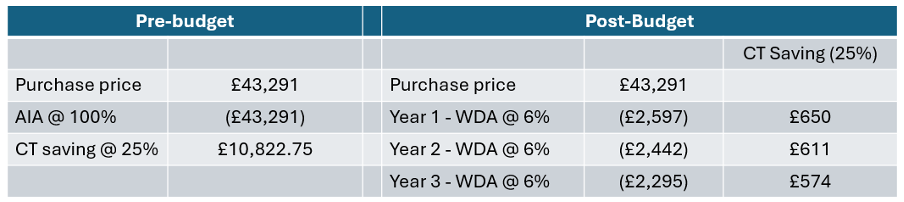

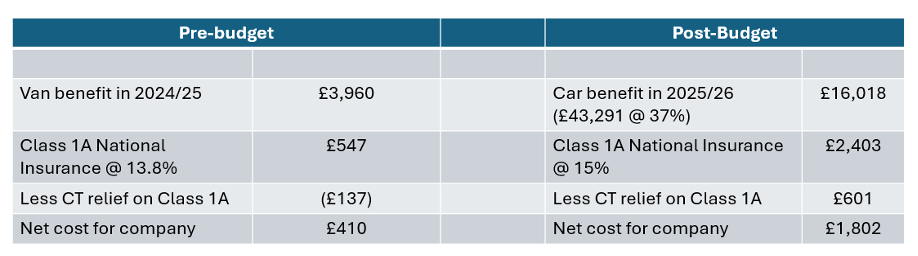

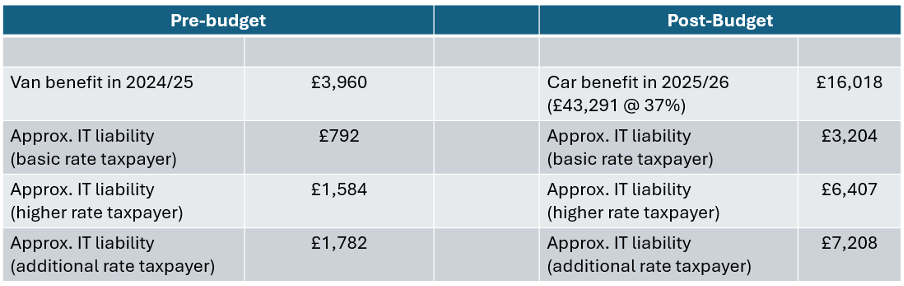

For a stereotypical double cab pickup with a list price of £43,291 and CO2 emissions of 259 g/km:

Capital Allowances

Benefit in Kind – Company

Benefit in Kind – Individual

As you can see from the calculations above, the changes to double cab pickups will result in significant increases in the cost of providing double cab pickups.

How do I mitigate the effect of these changes on my business?

Thankfully, businesses have been given enough time to plan for these changes in order to mitigate these tax changes:

- Bring forward the replacement of your existing double cab pickups prior to April 2025 to secure their tax treatment for the next five years.

- Change from double cab pickups to more stereotypical vans.

- Replace double cab pickups with electric alternatives which receive a more favourable tax treatment.

The above suggestions may or may not be possible for your business depending on your individual situation. We would recommend having a discussion with your accountant regarding which route is right for you and your business.

(E) enquiries@advaloremgroup.uk (T) 01908 219100 (W) advaloremgroup.uk