New VAT Penalties and Interest Charges

HMRC are introducing new VAT penalties and interest charges which will apply to everyone who submits a VAT Return from 1 January 2023. Financial penalties can arise if you summit your VAT Return late, AND if you make a late payment.

Who is affected?

The changes introduced by HMRC will affect everyone who submits a VAT Return for accounting periods starting on or after 1st January 2023.

If your VAT Return is nil or subject to a repayment of VAT by HMRC, and is filed late, you will be subject to penalty points and financial penalties.

What if my VAT Return is submitted late?

The penalties for late submissions will work on a points-based system.

Each VAT Return you submit late; you will receive one penalty point. If you reach the penalty point threshold, you will receive a £200 penalty in the first instance. You will then receive a further £200 penalty for each subsequent late submission.

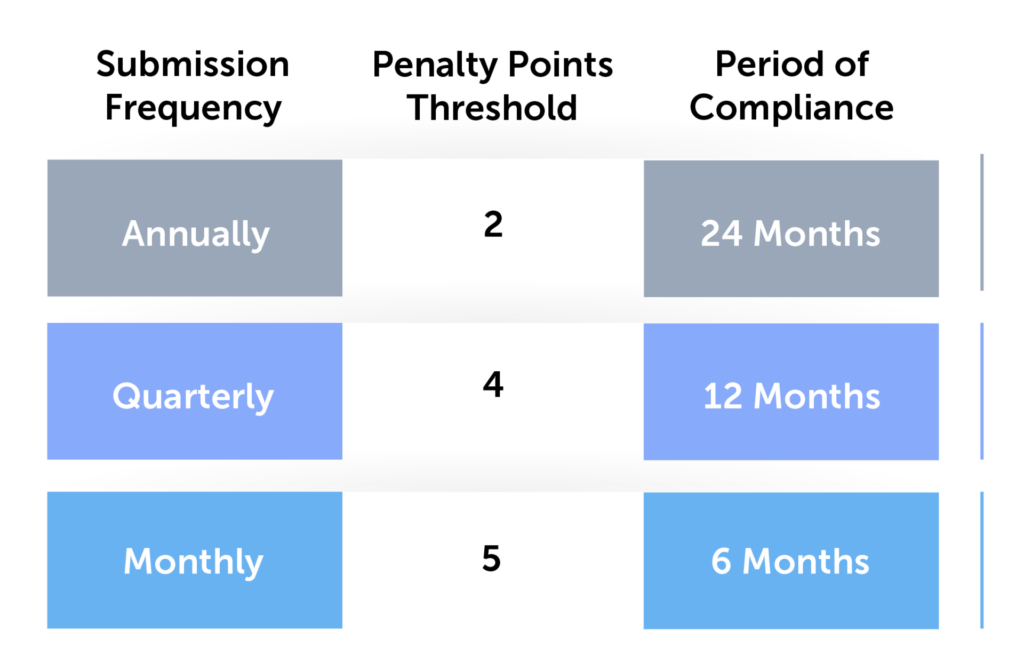

The penalty point thresholds vary dependent on how frequently you submit your VAT Returns.

In order to reset your points back to zero, you will need to:

- Ensure you file your returns on or before your VAT submission due date, for your “period of compliance:” Your period of compliance is dependent on your submission frequency and outlined in the table above.

- Make sure all outstanding returns for the previous 2 years have been filed with HMRC.

What if I miss a VAT payment?

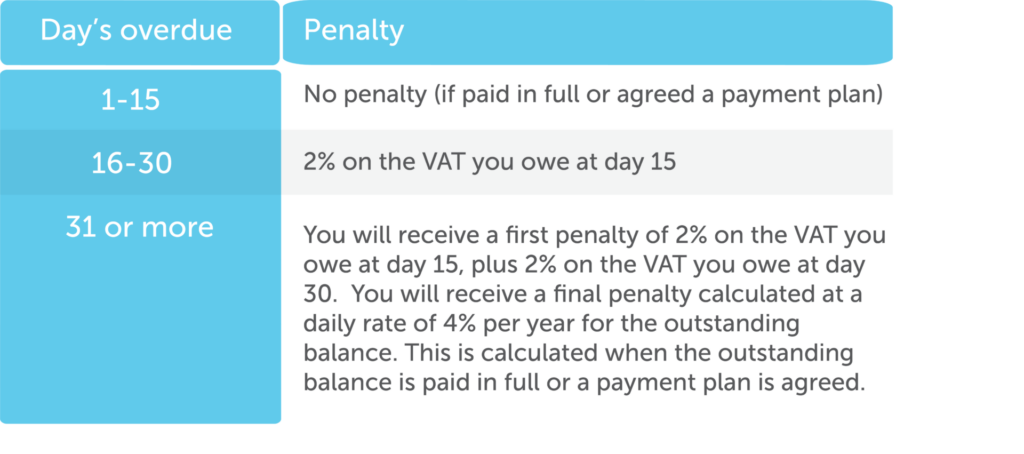

The sooner you make payment after your missed due date, the lower your penalty rate will be.

A grace period

To allow time to get used to the changes, HMRC will not be charging the first late payment penalty for the first year from 1st January 2023 until 31 December 2023, if you pay in full within 30 days of your payment due date.

How will late payment interest be charged?

From 1st January 2023, late payment interest will be charged from the day your payment is overdue to the day your payment is made in full.

Late payment interest is calculated at the Bank of England base rate plus 2.5%.

Introduction of repayment interest

The repayment supplement will be withdrawn from 1 January 2023.

If your accounting period starts on or after 1st January 2023, HMRC will pay you repayment interest on any VAT that you are owed.

The repayment interest will be calculated from the day after the due date or the date of submission (whichever is later) and until HMRC pays you the repayment VAT amount in full.

Repayment interest is calculated as the Bank of England base rate minus 1%, with a lower limit of 0.5%.

Essentially HMRC are bringing VAT penalties and interest payments more in line with their other taxation penalties and interest payments. If you have any questions regarding the upcoming changes, please contact us on:

(E) enquiries@advaloremgroup.uk (T) 01908 219100 (W) advaloremgroup.uk